|

Steering the AI Transition: The Case for More Employee Ownership New employee-ownership models might save us from AI-induced mass inequality |

Commentary

The compass of our current AI debate is mis-calibrated. If you google “AI” in the news these days, it is hard to find a story that is not focused on existential risk of omnipotent AI fully erasing humanity. Recently, Elon Musk predicted that such an Artificial General Intelligence (AGI) will be a reality within the next three years. For context, he also predicted fully operational autonomous vehicles by 2017, then by 2020 and then again by 2023. Like the Sirens in Greek mythology, the debate on AGI is entertaining but diverting us from the more immediate and pressing impacts of AI.

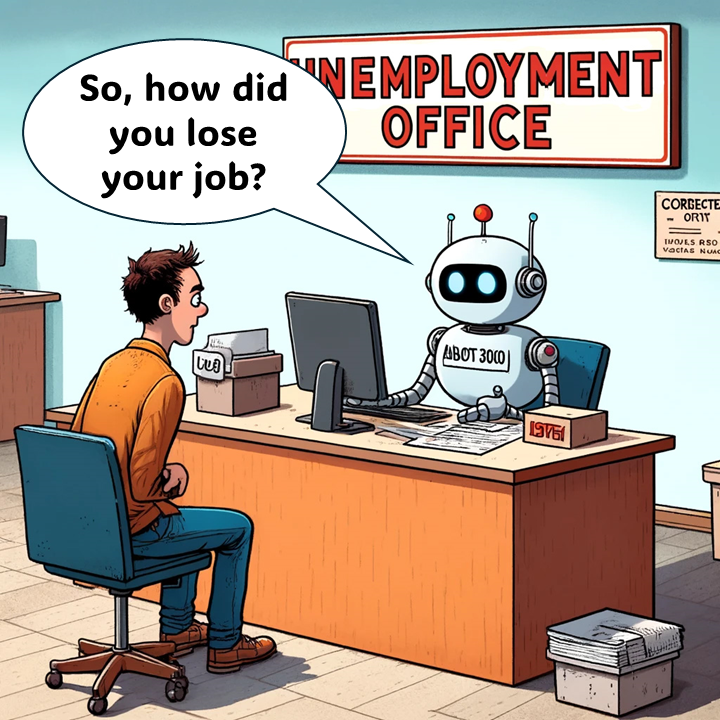

One impact that will materialize much faster than the emergence of AGI is a deflating effect of AI on employment and wages. In 2023, 37% of business leaders in the US said that AI replaced workers in their company, providing ammunition to experts like Kai-Fu Lee who have been warning that AI might lead to mass unemployment.[1]

Opponents of those doomsayers argue that we have seen technological revolutions multiple times before, and overall, things worked out fine for workers.[2] While I don’t buy into the doomsayers’ worst-case scenarios, my experience as an AI advisor to business executives and policymakers tells me this time is different. When the Industrial Revolution automated many types of physical labor, many workers moved into services with a higher share of knowledge work. For a long time, this seemed like a safe harbor for humans: after all, machines couldn’t create your business strategy, right? With the advent of generative AI, this paradigm changed. I see every day how AI systems are taking on more and more complex knowledge-based tasks. For example, a food manufacturing company in Canada is developing a GenAI tool to master the complex task of identifying root causes behind machine breakdowns. Currently, this job is being performed by highly experienced maintenance operators. In the future, GenAI will leverage machine sensor data and images, crawl through thousands of maintenance reports to identify the likeliest root cause and even contact suppliers to start the procurement process. This is terra incognita, and there doesn’t seem to be a safe harbor for human workers on the horizon.

“Who owns the robots will rule the world”, wrote Harvard’s Richard B. Freeman in 2015, referring to the productivity gains from robots flowing upstream to their owners while replacing human tasks.[3] But who owns the robots? Spoiler alert–not workers. In the US, less than 20% of employees participate in broad-based employee ownership programs.[4] If we continue this path, a large share of employees will see their incomes deflate, as more and more tasks will be transferred from humans to AI systems.

The good news is that we don’t have to reinvent the wheel to avoid AI-induced mass inequality – promising policy models already exist. One of the levers policymakers can leverage is to increase employee equity ownership. By owning a share of the company assets, workers can participate in AI-generated productivity gains and complement their income generated from labor. So far, the main vehicle for broad-based ownership in the US is employee stock ownership plans (ESOP), tax-advantaged retirement plans that invest primarily in company stock and hold their assets in accounts earmarked for employees who get paid out after they leave the company. The purpose of ESOPs is primarily to save for retirement, and not to bolster employees’ income until they leave the company.

Employee Ownership Trusts (EOT) represent an alternative option, piloted in the UK since 2014 and now increasingly popular in North America as well. In November 2023, the Canadian Government proposed significant tax incentives for EOTs, a measure that led to the rapid growth of EOTs in the UK.[5] Compared to ESOPs, EOTs have several advantages. First, they are comparatively inexpensive to create. The UK Government managed to dispel previous concerns that employee ownership was an unusual and complicated business model, whilst also providing a clear set of incentives to encourage transfers to EOTs.[6] Second, employees directly benefit from the trust by receiving a share of the profits while being employed, providing a form of insurance as automation advances. Companies that are controlled by an EOT can distribute tax-free profit shares to their employees each tax year up to an annual value of £3,600 per person.[7] While the significance of this amount can be debated, the concept itself is remarkable as a blueprint. And third, due to real-time profit sharing, EOTs can lead to increased competitiveness and a more collaborative culture between workers and management. For instance, the 2012 Nuttall Review, the landmark report that led to the UK’s tax incentives for EOTs, showed that such companies tended to outperform other businesses and were more resilient in economic downturns.[8] In a world where companies compete on a global scale, acceptance of new technologies in the workplace is essential to ensure no one falls behind in this AI-driven productivity race.

The UK has seen a significant increase in the adoption of EOTs since the introduction of supportive tax legislation in 2014. As of mid-2023, there were approximately 1,400 EOTs, a 40% increase from the previous year. Notable examples include John Lewis, Mott MacDonald, Arup Group and Howden Group Holdings. EOTs are less common in the US compared to the UK, but they are gaining traction.[9] Examples include Wimberly Allison Tong & Goo and Text-Em-All, which have adopted EOTs to foster long-term employee benefits and company stability. U.S. EOTs often focus on creating a perpetual trust model that shares profits with employees and promotes company independence.[10]

The impact of AI on workers’ wages will become critical in a matter of years, so it is important to put the right policy and legal structures in place now to steer the boat in the right direction. This will require efforts and partnerships across different stakeholder groups: in the case of EOT, policymakers around the world should copy the tax incentive schemes piloted in the UK and Canada. Business owners should seriously consider creating an EOT for their companies. Several non-profits, such as the National Center for Employee Ownership, provide support and guidance in this direction. Individuals who want to support this effort can lean on civil society organizations that are promoting employee ownership including EOTs, such as Fifty by Fifty. An initiative of The Democracy Collaborative, Fifty by Fifty aims to grow the number of employee owners in the U.S. to 50 million Americans by 2050. Lastly, voters who are thinking about which candidate to support in the next election should consider looking into candidates’ proposals on employee ownership. If everyone plays their role, we can build a future where empowerment through ownership isn't just an ideal, but the standard for economic participation in the AI era.

Bibliography

• Heffernan, Nora. “The Emergence of Employee Ownership Trusts in the US.” The Aspen Institute, November 30, 2023. https://www.aspeninstitute.org/blog-posts/the-emergence-of-employee-ownership-trusts-in-the-us/.

• Mann, Steve. “How Many Employee Ownership Trusts Are There In the UK? (And Why Are They Becoming So Popular?).” Go EO (blog), May 18, 2023. https://goeo.uk/blog/how-many-employee-ownership-trusts-are-there-in-the-uk/.

• Montpellier, Inga Fechner, Charlotte de. “AI Will Fundamentally Transform the Job Market but the Risk of Mass Unemployment Is Low.” ING Think. Accessed April 15, 2024. https://think.ing.com/articles/ai-will-fundamentally-transform-job-market-but-risk-of-mass-unemployment-is-low/.

• Pendleton, Andrew, Andrew Robinson, and Graeme Nuttall. “Employee Ownership in the UK.” Journal of Participation and Employee Ownership 6, no. 3 (January 1, 2023): 194–214. https://doi.org/10.1108/JPEO-11-2022-0030.

• “The Nuttall Review Of Employee Ownership - One Year On Report,” n.d.